The cost of living crisis is real, and it’s hitting everyone hard. From rent to groceries, everything is becoming more expensive than ever before. Luckily, there are a few things you can do to help mitigate the impact of the cost of living crisis.

In this blog post, we will explore ways to do so. From budgeting and shopping smart to find ways to reduce your utility bills, read on to find out how you can make life easier during these tough times.

Understand Your Expenses

If you’re feeling overwhelmed by the cost of living crisis, here are some ideas on ways to cope.

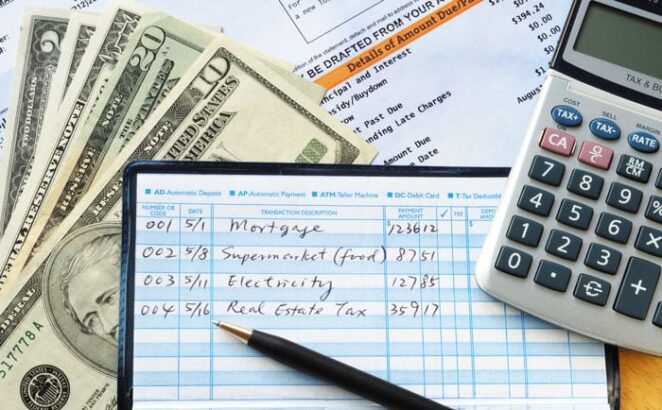

Before you can start trying to cut back on your expenses, it’s important to understand what’s costing you the most. Track your spending for a month and figure out where you can make adjustments.

1. Cut back on unnecessary spending

One of the quickest and simplest ways to reduce your expenses is to cut back on frivolous spending. Start by eliminating unnecessary subscriptions, buying items that you don’t need, and eating out less often. It might not be glamorous, but it will save you money in the long run.

2. Shop around for cheaper options

When looking for cheaper alternatives, don’t be afraid to look online or at discount stores. There are often great deals out there if you take the time to hunt them down and discount store Iowa offers exactly that.

3. Consolidate your bills into one payment each month

One way to save money on your monthly bills is to consolidate them into one payment each month. This can help avoid overspending in certain areas and help keep track of your overall budgeting progress.

4. Stick to a budgeted amount for groceries each week

This may seem like an unpopular suggestion, but sticking to a budgeted amount for groceries each week can really help tame expenses in other areas of your life as well. Not only will this help you stick to a tight financial plan, but it’ll also give you more money to save up for other important items.

5. Consider carpooling or taking public transportation

If you’re in a position where you can’t afford to drive your car, consider carpooling or taking public transportation. This can help you cut down on your gasoline expenses and also save on parking fees.

How to Make a Budget

Making a budget is one of the most important steps in saving money. Follow these simple steps to create your own budget and start saving money today!

Find out what you can live without. If you have a regular income, start by figuring out what you can live without. This includes things like cable TV, internet, and any unnecessary luxuries. Once you know what you can live without, it will be much easier to cut back on your expenses.

Figure out where your expenses are going the most. This includes things like groceries, transportation, and utilities. Try to find ways to reduce or eliminate these costs altogether!

Once you’ve established a baseline for yourself and made all of the necessary cuts, it’s time to stick to your budget every month! To do this effectively, set up a system in which you track your spending each week so that you have an idea of where your money is going. This will help keep you accountable and ensure that you don’t overspend on occasion!

Invest in Yourself

Investing in yourself begins with setting goals and understanding your personal motivation. When you have clarity about what you want to achieve, it is easier to identify the steps you need to take to get there.

Make time for exercise, restorative sleep, and relaxation techniques to help keep your body healthy and your mind sharpened. And don’t forget to take care of your emotional well-being – self-care is key to maintaining a positive outlook on life!

Don’t be afraid to take courses or programs that will improve your skillset – this could include things like learning new software or investing in certifications that will make you more marketable in your field.

Volunteering can also be a great way to gain experience in an area that interests you and make connections that might lead to future opportunities. There are many different volunteering opportunities available that cater to people of all skill levels, so don’t hesitate to explore them!

Create Savings Accounts

Savings accounts are a great way to save for the future. They come in a variety of shapes and sizes, so you can find one that fits your needs. Some savings accounts allow you to make automatic transfers from your checking account to your savings account, which can help you build your savings over time. There are also special savings accounts designed specifically for people who want to invest their money.

To get started saving, look at all of the different options available to you and choose the one that best fits your needs.

You can also open a traditional bank account and then use online or mobile apps to add money directly into your savings account from your checking account.

Whatever option you choose, be sure to read the terms and conditions carefully before opening an account. Many banks offer introductory interest rates on new accounts, so be sure to take advantage of these deals if they’re available. And don’t forget—savings are always important! Even small amounts can add up over time if saved regularly enough.

If you can’t seem to reduce your expenses or save any money on your own, consider looking into various financial counseling options. A financial counselor can help identify ways to reduce your expenses and set up a plan for saving money. Financial counseling may also provide some other helpful resources, such as budgeting tools or debt reduction tips.

Conclusion

Living in a cost-of-living crisis can be tough. It seems like everywhere you turn, there are prices going up and wages staying the same or decreasing. In today’s economy, it can be hard to make ends meet.

That’s why it’s so important to have a plan for when things start to get tough. From finding creative ways to save money on your groceries to learning about budgeting tools that can help you stick to your spending limits, we hope that our tips will help you get through this tough time.